Investor Relations

News & Publikationen - Blog: IR Mall

The Annual General Meeting of Deutsche EuroShop AG will take place on Thursday, 16 June 2011, at 10:00 a.m. CEST in the Handwerkskammer Hamburg, Holstenwall 12, D-20355 Hamburg.

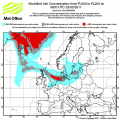

Even if you plan your roadshows and conferences months in advance you are not immune against vis major such as eruptions of a volcano.

2010 it was Eyjafjallajökull in Iceland which erupted from April until October and influenced the air travel in Europe for weeks.

This year another Icelandic volcano disturbs (not only) the roadshow activities of many European companies: Grímsvötn.

We published our Q1 2011 results this morning. Surprisingly we get the most questions about the time of our conference call - but there won't be any!

To make your forecasts it may help to have the comparable numbers

of Q1 2010.

The Excel sheet offers a full usability. You can start with your projections right here!

Today we published - together with our co-operation partner DVFA - the results of the survey "The Use of Social Media by European Investment Professionals".