Investor Relations

Share

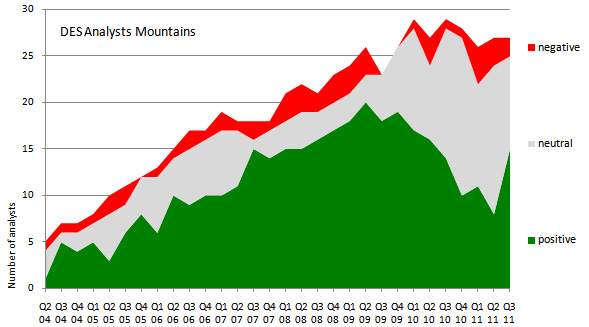

We've designed a new chart which shows the quarterly development of our analysts' recommendations over the last 7 years (since Q2 2004). Additionally it shows our way to become one of the best covered real estate companies in Europe (according to EPRA, 3/11), starting with only a few analysts.

Dexia S.A. (Belgium) has informed us that its voting rights on Deutsche EuroShop have exceeded the 3% threshold and amount to 3.02% (1,559,004 shares; total number of DES' shares: 51,631,400).

We want to take this occasion to update our shareholder structure.

Deutsche EuroShop now has around 10,000 shareholders (as at: 27 July 2011). The structural distribution is very stable: institutional investors hold around 56% of the shares, and private investors around 29%. The Otto family’s stake is 15%. The investment company BlackRock currently holds 3.3% of the shares, Dexia - as already mentioned - holds 3.02%.

On 24 February 2011 we published our preliminary results for 2010.

To take into account the capital increases that took place during the year and also a capital increase maybe carried out after the balance sheet date and prior to publication, in accordance with IAS 33 a time-weighting factor and a retrospective adjustment of the number of shares must be applied when determining the basic earnings per share.