Investor Relations

|

subscribe to RSS-Feed |

Deutsche EuroShop AG Hauptversammlung 2025

Hauptversammlungsrede von Vorstand Hans-Peter Kneip am 27. Juni 2025 in der Hamburger Handwerkskammer Weitere Informationen unter https://www.deutsche-euroshop.de/HV

Deutsche EuroShop | Conference Call | Financial Results 2024

Webcast of the telephone conference including the slide presentation Presenter: Hans-Peter Kneip, CFO 28.03.2025, 10.00 a.m., CET www.deutsche-euroshop.com/ir

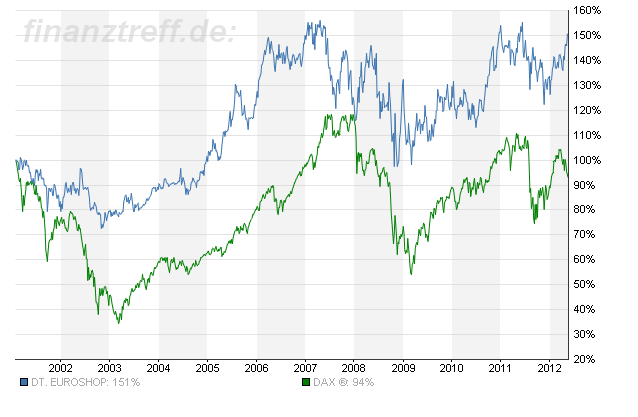

In the long run...

When Deutsche EuroShop went public at the beginning of 2001 the idea/wish was to reach a performance (share price development + dividends) which should be comparable to the long-term average performance of the DAX (Germany's blue chip index), which was approx. +8% per annum at this time.

Times have changed and the DAX currently doesn't deliver this total return. Since DES' IPO the DAX had an absolute performance of -2.5% which translates into a -0.2% per year.

Positive: Deutsche EuroShop so far fulfilled the orginal idea with a +7.9% performance per year.

Our share beat all relevant benchmarks like the MDAX (German midcap index) and the EPRA (Europe Total Return) index.

When investors compare Deutsche EuroShop's stability as a "bond-like character" they are on the right track. But the DES share was able to outperform the REX (German government bonds performance index) in the last approx. 11.5 years.

| Deutsche EuroShop | DAX | MDAX | REX | EPRA | |

| Since

DES-IPO (2001) 02.01.2001-18.05.2012 |

+131.5% +7.9% p.a. |

-2.5%

-0.2% p.a. |

+114.8%

+5.9% p.a. |

+82.9%

+5.6% p.a. |

+78.3%

+5.4% p.a. |

We can't promise this development for the next decade, but our targets in this context are unchanged.